Tesla (TSLA 2.41%) has long been associated with artificial intelligence (AI). Without AI, there can be no self-driving cars, a sizable part of Tesla’s investment thesis. Tesla has benefited from this newfound interest in AI investing, as the stock is up nearly 60% since AI became the hottest topic in the investment world in early May.

But can AI seriously push Tesla stock to a new high? Or is AI just another investment bubble waiting to burst? Let’s find out.

Tesla uses artificial intelligence, but not for the same purpose as many others

Tesla’s AI efforts are focused on researching self-driving cars. With millions of Teslas on the road, it collects an immense amount of data to train its self-driving system. However, his ability to process this information and improve the model lacked, so he designed his own supercomputer Dojo.

Tesla built this supercomputer with one task in mind: to use videos of Tesla vehicles to train its AI model. This much-anticipated improvement should help with Tesla’s AI processing capabilities and further bring its self-driving model into the mainstream.

However, the problem with Tesla’s latest rally is that most of the interest in AI is in large language model (LLM) chatbots, and this doesn’t necessarily translate into AI research at Tesla.

Undoubtedly, there will be some improvements in AI-related technology, but this has no chance of affecting Tesla’s business beyond its pursuit of autonomous driving.

And if you look at its valuation, it trades as if it’s already achieved widespread implementation.

Stock is expensive

In the fourth quarter of 2022, Tesla disclosed that it has approximately 400,000 vehicles with its self-driving product (FSD) installed on the road. With the basic Autopilot FSD upgrade costing $199 a month and a $15,000 base cost required to install the product in a car, it has serious potential to become a huge revenue driver for Tesla. However, Tesla didn’t disclose how many of those cars have the $199-per-month add-on.

The FSD is much more advanced than the autopilot. The basic autopilot requires a fully attentive driver and is similar to what many new cars on the road already have: adaptive cruise control and automatic steering to keep the car within your lane. FSD allows the vehicle to operate autonomously and can stop at traffic lights and signals, as well as drive you home from a job.

If all 400,000 vehicles have it, that generates nearly $1 billion in annual revenue for Tesla. Furthermore, any additional revenue from FSD subscriptions would essentially be 100% profit (after deducting the cost of revenues), as Tesla is already spending money on its engineering staff to create this capability.

This effect, known as reaching scale, is powerful because a product has two main types of costs: fixed and variable. Fixed costs are the cost of goods, which in the case of a software product is very low. Variable costs include the operating expenses required to deliver the product. Tesla doesn’t need to double its engineering staff just to account for double FSD enrollments. as a result, a significant portion of this revenue goes into profits.

So as AI hype sweeps across the tech world, the main boost it will give Tesla is that prospective car buyers can choose to install the expensive FSD equipment into their new vehicles. However, this doesn’t sound like a solid investment case for the stock, so this latest rally could just be a flash in the pan.

At 75x earnings, Tesla is down significantly from its highs, but it’s still an incredibly expensive stock, regardless of sector.

TSLA PE Ratio data from YCharts

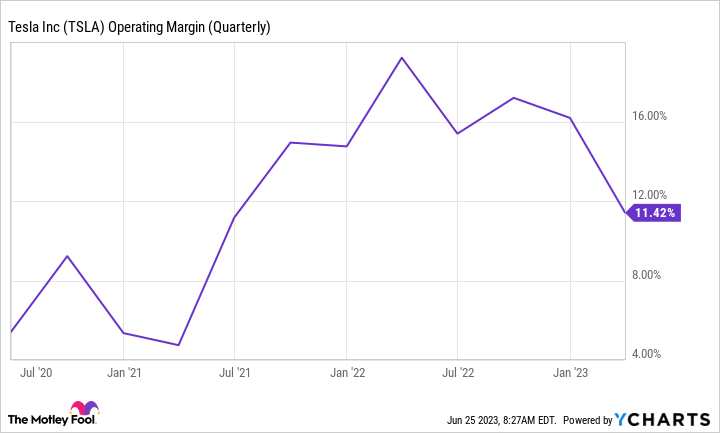

Additionally, Tesla’s margins have come under pressure thanks to price cuts.

TSLA Operating Margin Data (Quarterly) by YCharts

Lower operating margins mean lower earnings, which will increase your price/earnings ratio. One way to reverse this trend is to generate higher margin revenue, such as FSD subscriptions.

However, until we see material results suggesting interest in AI will translate into interest in FSD, this rally is not sustainable. As a result, I think investors should avoid Tesla stock after its latest rally. However, if Tesla comes back down to earth and trades at a more reasonable valuation, the stock would be a bit more attractive. Until then (or until Tesla reports big gains), I don’t add any more capital to my position.

#Artificial #Intelligence #Tesla #Stock #Hit #AllTime #High #Year #motley #fool

Image Source : www.fool.com